Home Sales and Listings Down While Selling Price and Rent Up

TORONTO, ONTARIO, January 5, 2023 – The Greater Toronto Area (GTA) housing market experienced a marked adjustment in 2022 compared to record levels in 2021.

Existing affordability issues brought about by a lack of housing supply were exacerbated by sustained interest rate hikes by the Bank of Canada.

“Following a very strong start to the year, home sales trended lower in the spring and summer of 2022, as aggressive Bank of Canada interest rate hikes further hampered housing affordability. With no relief from the Office of Superintendent of Financial Institutions (OSFI) mortgage stress test or other mortgage lending guidelines including amortization periods, home selling prices adjusted downward to mitigate the impact of higher mortgage rates. However, home prices started levelling off in the late summer, suggesting the aggressive early market adjustment may be coming to an end,” said new Toronto Regional Real Estate Board (TRREB) President Paul Baron.

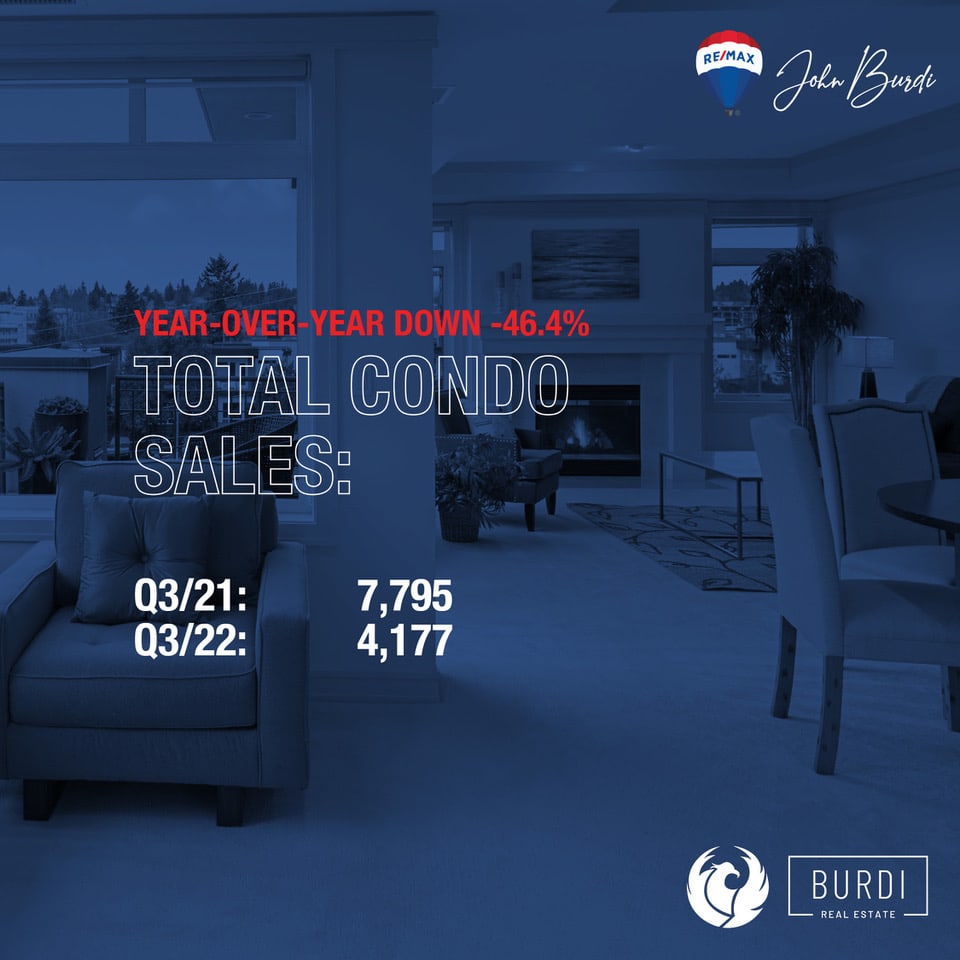

There were 75,140 sales reported through TRREB’s MLS® System in 2022 – down 38.2% compared to the 2021 record of 121,639. The number of new listings amounted to 152,873 – down 8.2% compared to 166,600 new listings in 2021.

Seasonally adjusted monthly data for sales and price data show a marked flattening of the sales and price trends since the late summer. “While home sales and prices dominated the headlines in 2022, the supply of new listings continued to be an issue as well. The number of homes listed for sale in 2022 was down in comparison to 2021. This helps explain why selling prices have found some support in recent months. Lack of supply has also impacted the rental market. As renting has become more popular in this higher interest rate environment, tighter rental market conditions have translated into double-digit average rent increases,” said TRREB Chief Market Analyst Jason Mercer.

The average selling price for 2022 was $1,189,850 – up 8.6% compared to $1,095,333 in 2021. This growth was based on a strong start to the year, in terms of year-over-year price growth. The pace of growth moderated from the spring of 2022 onwards.

As we look forward into 2023, there will be two opposite forces impacting the housing market. On the one hand, we will continue to feel the impact of higher borrowing costs. On the other hand, record levels of immigration will support demand for ownership and rental housing, while we struggle to come to terms with a housing and infrastructure deficit in the Greater Golden Horseshoe.

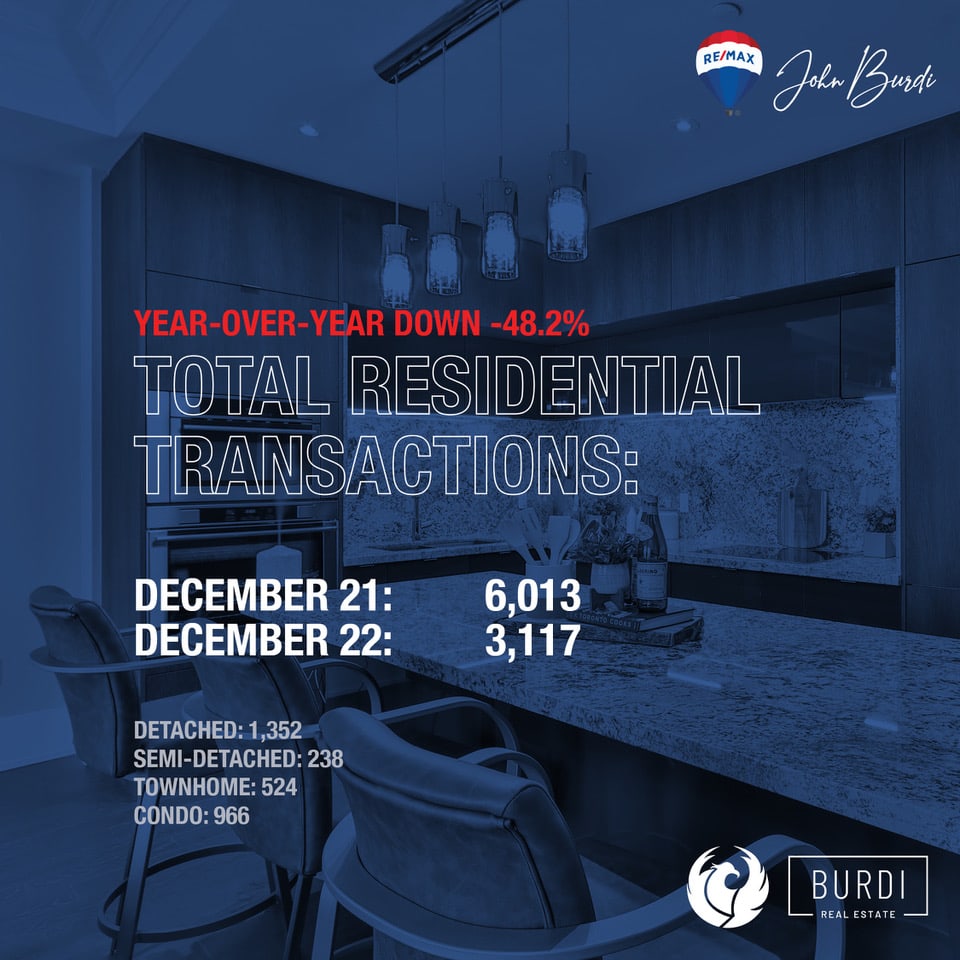

December 2022 Results

- There were 3,117 sales reported through TRREB’s MLS® System in December 2022 – down 48.2% compared to December 2021.

- New listings totalled 4,074 – down 21.3% compared to 5,177 in December 2021.

- The MLS® Home Price Index Composite benchmark was down 8.9% on a year-over-year basis in December 2022.

- The December average selling price, at $1,051,216, was down by 9.2% compared to the December 2021 average of $1,157,837.