February home sales were down compared to the all-time record in 2021, but represented the second-best result for the month of February in history. New listings dropped, but by a marginally lesser annual rate than sales, pointing to a modest move to a slightly more balanced market. Competition between buyers, however, remained tight enough to support double-digit price growth year-over-year.

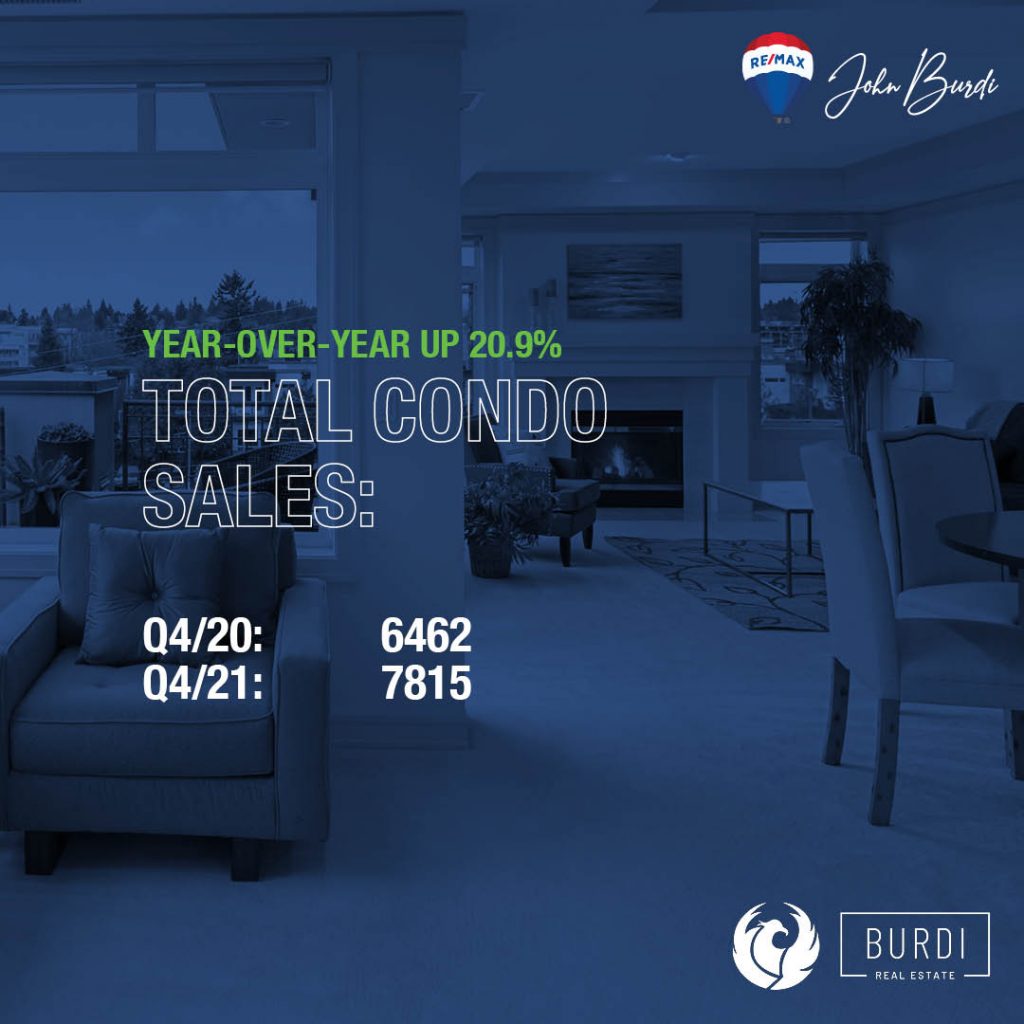

Greater Toronto Area (GTA) REALTORS® reported 9,097 sales through the Toronto Regional Real Estate Board’s (TRREB) MLS® System in February 2022, representing a 16.8% decrease in the number of sales compared to February 2021. The supply of listings for low-rise home types (detached, semi-detached and townhouses) was also down year-over-year, but not by as much as sales. In the condominium apartment segment, particularly in Toronto, new listings were up in comparison to February 2021. “Demand for ownership housing remains strong throughout the GTA, and while we are marginally off the record pace seen last year, any buyer looking in this market is not likely to feel it with competition remaining the norm.

Many households sped up their home purchase and entered into a transaction in 2021, which is one reason the number of sales were forecasted to be lower this year and a trending towards higher borrowing cost will have a moderating effect on home sales. Substantial immigration levels and a continued lack of supply, however, will have a countering effect to increasing mortgage costs,” said TRREB President Kevin Crigger. The MLS® Home Price Index Composite Benchmark was up by 35.9% year-over-year in February.

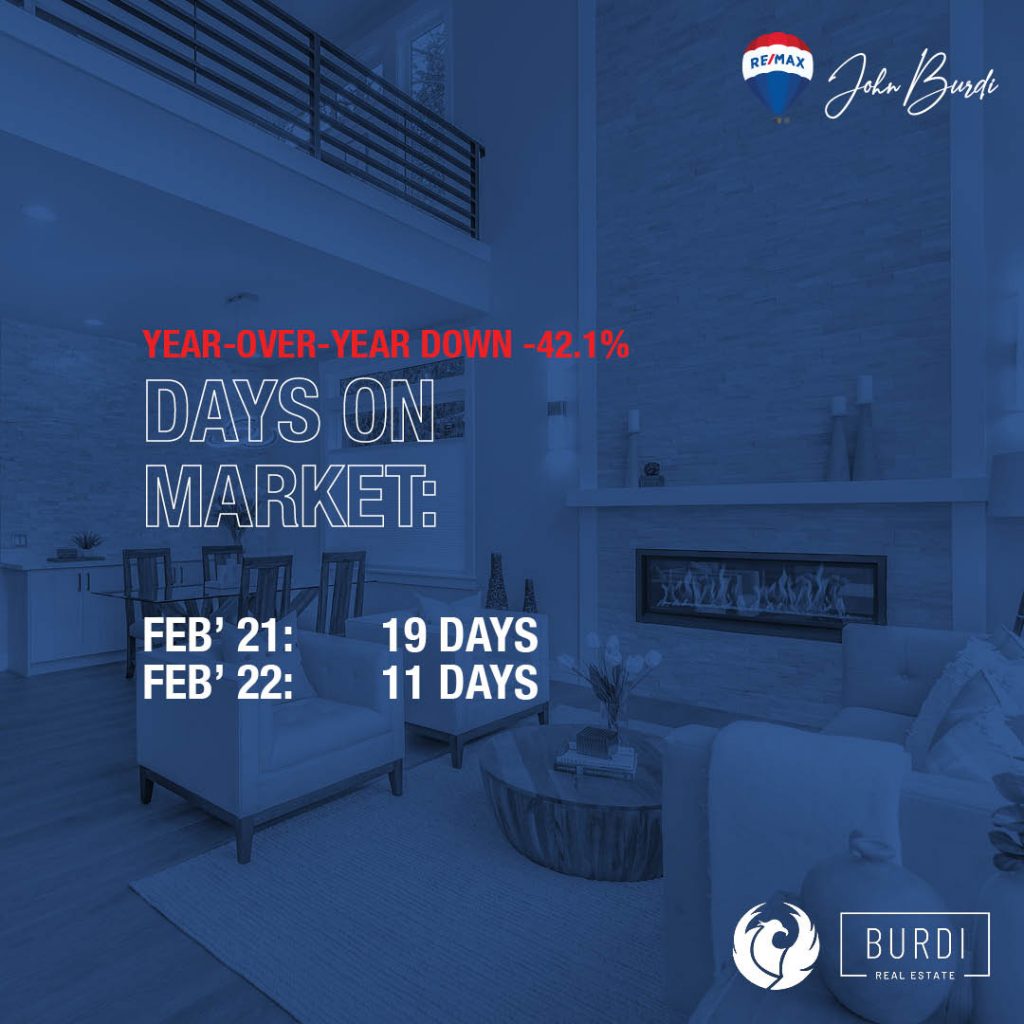

?The average selling price for all home types combined was up by 27.7% to $1,334,544. The pace of price growth varied by home type and region, but there was relative parity between low-rise and condominium apartment growth rates. “We have seen a slight balancing in the market so far this year, with sales dipping more than new listings. However, because inventory remains exceptionally low, it will take some time for the pace of price growth to slow. Look for a more moderate pace of price growth in the second half of 2022, as higher borrowing costs result in some households putting their home purchase on hold temporarily as they resituate themselves in the market,” said TRREB Chief Market Analyst Jason Mercer.

View the full stats below:

Quick view

https://trreb.ca/index.php/

Market watch (full)